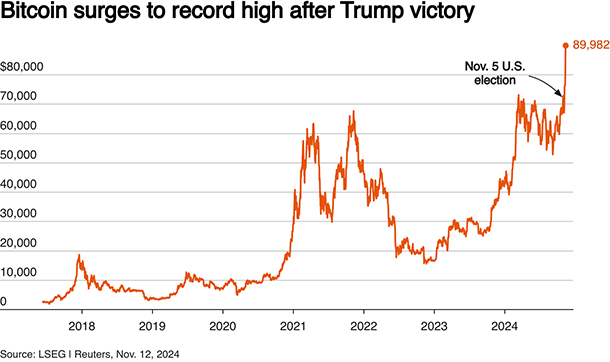

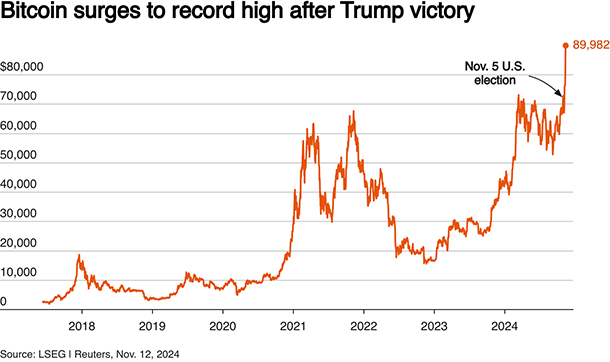

Market analysts see this shift as a trigger for further government interest in cryptocurrency, potentially driving other countries to adopt Bitcoin to stay competitive. Crypto-related stocks responded swiftly, with companies like Riot Platforms, MARA Holdings, and CleanSpark witnessing substantial gains. MicroStrategy, a major Bitcoin investor, also saw shares jump after investing $2 billion in Bitcoin. Experts suggest this Trump-driven crypto rally could increase demand not only for Bitcoin but for crypto stocks as a whole. Bitcoin surges to record high above $89,000 after Trump election victoryBitcoin’s Record-Breaking Rally Nears $90,000 on Trump’s Crypto-Friendly VisionBitcoin surged to unprecedented levels on Tuesday, nearing the $90,000 milestone. Following President-elect Donald Trump's election win, the cryptocurrency has gained momentum, spiking about 30% since November 5, with a peak at $89,982. Bitcoin has been one of the most striking performers in the financial world since Trump’s election, stirring significant interest among investors who foresee a supportive crypto environment under his administration.Trump’s election has led many to anticipate a pro-crypto U.S. government, with Trump positioning himself as a champion for digital assets, even promising to make America the “crypto capital of the planet” during his campaign. Trump’s stance is speculative but has nevertheless catalyzed a dramatic surge in crypto mining and trading stocks.Crypto Enthusiasts See a Strong Ally in Trump’s New AdministrationAlvin Tan, head of Asia FX strategy at RBC Capital Markets, notes that Bitcoin’s price can be volatile due to its lack of a valuation anchor, making it particularly sensitive to investor sentiment. Under Trump, the sentiment among crypto investors is strongly positive. Trump’s apparent alignment with digital assets is a boost to both crypto stocks and currencies.Matthew Dibb, Chief Investment Officer at Astronaut Capital, believes the U.S. adopting a national Bitcoin reserve could prompt other nations to adopt similar strategies, potentially fueling global demand for Bitcoin. Analysts predict that U.S. listed Bitcoin mining companies could benefit immensely from Trump’s plans, especially if nationalization becomes a possibility.Crypto and Mining Stocks Soar in ResponseCrypto stocks surged alongside Bitcoin’s gains, with shares in mining giants like Riot Platforms jumping nearly 17% and MARA Holdings and CleanSpark leaping nearly 30%. Meanwhile, MicroStrategy, a prominent Bitcoin investor, confirmed a new $2 billion Bitcoin purchase that sent its shares up by 26% on Monday. Nick Twidale, chief market analyst at ATFX Global, views this as a direct result of Trump’s pro-crypto stance, which has spurred demand for both crypto-related stocks and digital assets.

Bitcoin surges to record high above $89,000 after Trump election victoryBitcoin’s Record-Breaking Rally Nears $90,000 on Trump’s Crypto-Friendly VisionBitcoin surged to unprecedented levels on Tuesday, nearing the $90,000 milestone. Following President-elect Donald Trump's election win, the cryptocurrency has gained momentum, spiking about 30% since November 5, with a peak at $89,982. Bitcoin has been one of the most striking performers in the financial world since Trump’s election, stirring significant interest among investors who foresee a supportive crypto environment under his administration.Trump’s election has led many to anticipate a pro-crypto U.S. government, with Trump positioning himself as a champion for digital assets, even promising to make America the “crypto capital of the planet” during his campaign. Trump’s stance is speculative but has nevertheless catalyzed a dramatic surge in crypto mining and trading stocks.Crypto Enthusiasts See a Strong Ally in Trump’s New AdministrationAlvin Tan, head of Asia FX strategy at RBC Capital Markets, notes that Bitcoin’s price can be volatile due to its lack of a valuation anchor, making it particularly sensitive to investor sentiment. Under Trump, the sentiment among crypto investors is strongly positive. Trump’s apparent alignment with digital assets is a boost to both crypto stocks and currencies.Matthew Dibb, Chief Investment Officer at Astronaut Capital, believes the U.S. adopting a national Bitcoin reserve could prompt other nations to adopt similar strategies, potentially fueling global demand for Bitcoin. Analysts predict that U.S. listed Bitcoin mining companies could benefit immensely from Trump’s plans, especially if nationalization becomes a possibility.Crypto and Mining Stocks Soar in ResponseCrypto stocks surged alongside Bitcoin’s gains, with shares in mining giants like Riot Platforms jumping nearly 17% and MARA Holdings and CleanSpark leaping nearly 30%. Meanwhile, MicroStrategy, a prominent Bitcoin investor, confirmed a new $2 billion Bitcoin purchase that sent its shares up by 26% on Monday. Nick Twidale, chief market analyst at ATFX Global, views this as a direct result of Trump’s pro-crypto stance, which has spurred demand for both crypto-related stocks and digital assets.

Bitcoin surges to record high above $89,000 after Trump election victoryBitcoin’s Record-Breaking Rally Nears $90,000 on Trump’s Crypto-Friendly VisionBitcoin surged to unprecedented levels on Tuesday, nearing the $90,000 milestone. Following President-elect Donald Trump's election win, the cryptocurrency has gained momentum, spiking about 30% since November 5, with a peak at $89,982. Bitcoin has been one of the most striking performers in the financial world since Trump’s election, stirring significant interest among investors who foresee a supportive crypto environment under his administration.Trump’s election has led many to anticipate a pro-crypto U.S. government, with Trump positioning himself as a champion for digital assets, even promising to make America the “crypto capital of the planet” during his campaign. Trump’s stance is speculative but has nevertheless catalyzed a dramatic surge in crypto mining and trading stocks.Crypto Enthusiasts See a Strong Ally in Trump’s New AdministrationAlvin Tan, head of Asia FX strategy at RBC Capital Markets, notes that Bitcoin’s price can be volatile due to its lack of a valuation anchor, making it particularly sensitive to investor sentiment. Under Trump, the sentiment among crypto investors is strongly positive. Trump’s apparent alignment with digital assets is a boost to both crypto stocks and currencies.Matthew Dibb, Chief Investment Officer at Astronaut Capital, believes the U.S. adopting a national Bitcoin reserve could prompt other nations to adopt similar strategies, potentially fueling global demand for Bitcoin. Analysts predict that U.S. listed Bitcoin mining companies could benefit immensely from Trump’s plans, especially if nationalization becomes a possibility.Crypto and Mining Stocks Soar in ResponseCrypto stocks surged alongside Bitcoin’s gains, with shares in mining giants like Riot Platforms jumping nearly 17% and MARA Holdings and CleanSpark leaping nearly 30%. Meanwhile, MicroStrategy, a prominent Bitcoin investor, confirmed a new $2 billion Bitcoin purchase that sent its shares up by 26% on Monday. Nick Twidale, chief market analyst at ATFX Global, views this as a direct result of Trump’s pro-crypto stance, which has spurred demand for both crypto-related stocks and digital assets.

Bitcoin surges to record high above $89,000 after Trump election victoryBitcoin’s Record-Breaking Rally Nears $90,000 on Trump’s Crypto-Friendly VisionBitcoin surged to unprecedented levels on Tuesday, nearing the $90,000 milestone. Following President-elect Donald Trump's election win, the cryptocurrency has gained momentum, spiking about 30% since November 5, with a peak at $89,982. Bitcoin has been one of the most striking performers in the financial world since Trump’s election, stirring significant interest among investors who foresee a supportive crypto environment under his administration.Trump’s election has led many to anticipate a pro-crypto U.S. government, with Trump positioning himself as a champion for digital assets, even promising to make America the “crypto capital of the planet” during his campaign. Trump’s stance is speculative but has nevertheless catalyzed a dramatic surge in crypto mining and trading stocks.Crypto Enthusiasts See a Strong Ally in Trump’s New AdministrationAlvin Tan, head of Asia FX strategy at RBC Capital Markets, notes that Bitcoin’s price can be volatile due to its lack of a valuation anchor, making it particularly sensitive to investor sentiment. Under Trump, the sentiment among crypto investors is strongly positive. Trump’s apparent alignment with digital assets is a boost to both crypto stocks and currencies.Matthew Dibb, Chief Investment Officer at Astronaut Capital, believes the U.S. adopting a national Bitcoin reserve could prompt other nations to adopt similar strategies, potentially fueling global demand for Bitcoin. Analysts predict that U.S. listed Bitcoin mining companies could benefit immensely from Trump’s plans, especially if nationalization becomes a possibility.Crypto and Mining Stocks Soar in ResponseCrypto stocks surged alongside Bitcoin’s gains, with shares in mining giants like Riot Platforms jumping nearly 17% and MARA Holdings and CleanSpark leaping nearly 30%. Meanwhile, MicroStrategy, a prominent Bitcoin investor, confirmed a new $2 billion Bitcoin purchase that sent its shares up by 26% on Monday. Nick Twidale, chief market analyst at ATFX Global, views this as a direct result of Trump’s pro-crypto stance, which has spurred demand for both crypto-related stocks and digital assets.