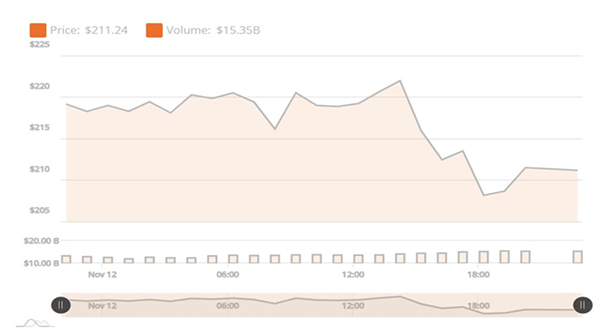

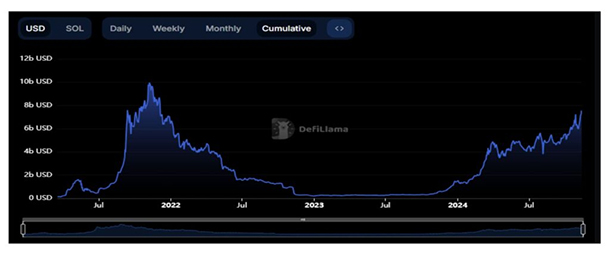

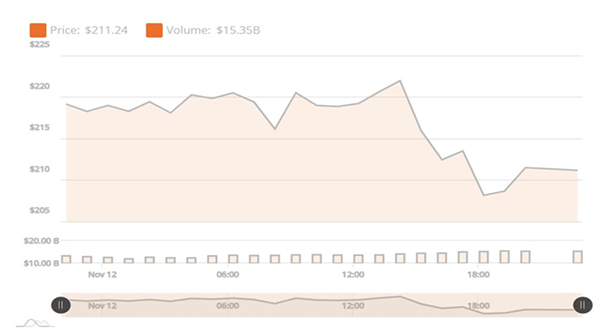

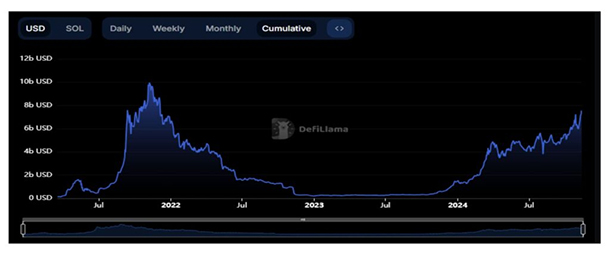

increase that coincided with a positive shift in market sentiment following Donald Trump’s election win. Breaking through the $190-$200 resistance level, which held for nearly seven months, SOL has now sparked speculation of potentially reaching $1,000 by cycle’s end. Some analysts even project a surge as high as $1,900, drawing parallels with Solana’s 2021 bull run, where a similar consolidation period was followed by a 900% rally. Solana’s recent momentum signals a possible long-term upward trend, especially with daily trading volumes up by 27%, as reported by Coingecko. The jump in volume, totaling $15.35 million, validates this breakout as genuine, reducing the risk of a false upward move. Notably, SOL’s strong performance has been bolstered by political shifts and Canary Capital’s application for a Solana ETF, which could amplify gains. Since November 5, SOL has surged 35%, achieving a peak of $222—its highest since December 2021. Bitcoin’s own ascent, now trading at $84,500, further boosts optimism for Solana’s upward trajectory, largely driven by institutional interest and potential regulatory clarity.Solana’s TVL (total value locked) has also reached a new peak of $7.6 billion, outperforming many other altcoins. The rise in TVL, fueled by popular applications like Jito, Raydium, and Binance’s liquid staking, highlights the increasing utility and adoption of Solana’s ecosystem. Despite some concerns over Solana’s exposure to high-profile memecoins like Dogwifhat (WIF) and Bonk (BONK), its growing TVL and active smart contract use show strong fundamentals that could support future gains.Solana is now eyeing resistance levels at the 0.27 and 0.618 Fibonacci extensions, respectively $260 and $330, with the next major psychological target at $400. Analysts expect the $180-$200 range, previously a resistance zone, to provide solid support if SOL faces a pullback, offering a potential rebound zone for continued upward movement. With strong technical indicators and a favorable macroeconomic environment, SOL could be positioned for further gains in the near future.

Solana’s recent momentum signals a possible long-term upward trend, especially with daily trading volumes up by 27%, as reported by Coingecko. The jump in volume, totaling $15.35 million, validates this breakout as genuine, reducing the risk of a false upward move. Notably, SOL’s strong performance has been bolstered by political shifts and Canary Capital’s application for a Solana ETF, which could amplify gains. Since November 5, SOL has surged 35%, achieving a peak of $222—its highest since December 2021. Bitcoin’s own ascent, now trading at $84,500, further boosts optimism for Solana’s upward trajectory, largely driven by institutional interest and potential regulatory clarity.Solana’s TVL (total value locked) has also reached a new peak of $7.6 billion, outperforming many other altcoins. The rise in TVL, fueled by popular applications like Jito, Raydium, and Binance’s liquid staking, highlights the increasing utility and adoption of Solana’s ecosystem. Despite some concerns over Solana’s exposure to high-profile memecoins like Dogwifhat (WIF) and Bonk (BONK), its growing TVL and active smart contract use show strong fundamentals that could support future gains.Solana is now eyeing resistance levels at the 0.27 and 0.618 Fibonacci extensions, respectively $260 and $330, with the next major psychological target at $400. Analysts expect the $180-$200 range, previously a resistance zone, to provide solid support if SOL faces a pullback, offering a potential rebound zone for continued upward movement. With strong technical indicators and a favorable macroeconomic environment, SOL could be positioned for further gains in the near future. Solana’s bullish momentum has sparked fresh interest in its price potential as it broke past critical resistance zones, positioning itself for a significant rally. Starting November 5, Solana ended a prolonged consolidation period, marking a 14% gain that coincided with a sentiment boost from Donald Trump’s election win. Trading volumes spiked 27%, and high daily volumes lend credibility to Solana’s breakout, suggesting sustained growth as long as it holds above $200. Further enhancing market optimism, Canary Capital recently filed for a Solana ETF, potentially adding an institutional layer to SOL’s upward momentum.Solana’s growing TVL—now at $7.6 billion—demonstrates its expanding utility, with top decentralized applications like Raydium and Jito attracting notable capital inflows. Though Solana’s reliance on memecoins like Dogwifhat (WIF) and Bonk (BONK) has raised concerns, its expanding TVL and robust smart contract activity underscore strong fundamentals for continued growth. Analysts have identified key resistance points, with $260 and $330 as significant Fibonacci levels to watch. A move beyond $400 would likely bring Solana within reach of its ambitious targets, with a potential rebound off the $180-$200 range providing solid support if a downturn occurs.

Solana’s bullish momentum has sparked fresh interest in its price potential as it broke past critical resistance zones, positioning itself for a significant rally. Starting November 5, Solana ended a prolonged consolidation period, marking a 14% gain that coincided with a sentiment boost from Donald Trump’s election win. Trading volumes spiked 27%, and high daily volumes lend credibility to Solana’s breakout, suggesting sustained growth as long as it holds above $200. Further enhancing market optimism, Canary Capital recently filed for a Solana ETF, potentially adding an institutional layer to SOL’s upward momentum.Solana’s growing TVL—now at $7.6 billion—demonstrates its expanding utility, with top decentralized applications like Raydium and Jito attracting notable capital inflows. Though Solana’s reliance on memecoins like Dogwifhat (WIF) and Bonk (BONK) has raised concerns, its expanding TVL and robust smart contract activity underscore strong fundamentals for continued growth. Analysts have identified key resistance points, with $260 and $330 as significant Fibonacci levels to watch. A move beyond $400 would likely bring Solana within reach of its ambitious targets, with a potential rebound off the $180-$200 range providing solid support if a downturn occurs.

Solana’s recent momentum signals a possible long-term upward trend, especially with daily trading volumes up by 27%, as reported by Coingecko. The jump in volume, totaling $15.35 million, validates this breakout as genuine, reducing the risk of a false upward move. Notably, SOL’s strong performance has been bolstered by political shifts and Canary Capital’s application for a Solana ETF, which could amplify gains. Since November 5, SOL has surged 35%, achieving a peak of $222—its highest since December 2021. Bitcoin’s own ascent, now trading at $84,500, further boosts optimism for Solana’s upward trajectory, largely driven by institutional interest and potential regulatory clarity.Solana’s TVL (total value locked) has also reached a new peak of $7.6 billion, outperforming many other altcoins. The rise in TVL, fueled by popular applications like Jito, Raydium, and Binance’s liquid staking, highlights the increasing utility and adoption of Solana’s ecosystem. Despite some concerns over Solana’s exposure to high-profile memecoins like Dogwifhat (WIF) and Bonk (BONK), its growing TVL and active smart contract use show strong fundamentals that could support future gains.Solana is now eyeing resistance levels at the 0.27 and 0.618 Fibonacci extensions, respectively $260 and $330, with the next major psychological target at $400. Analysts expect the $180-$200 range, previously a resistance zone, to provide solid support if SOL faces a pullback, offering a potential rebound zone for continued upward movement. With strong technical indicators and a favorable macroeconomic environment, SOL could be positioned for further gains in the near future.

Solana’s recent momentum signals a possible long-term upward trend, especially with daily trading volumes up by 27%, as reported by Coingecko. The jump in volume, totaling $15.35 million, validates this breakout as genuine, reducing the risk of a false upward move. Notably, SOL’s strong performance has been bolstered by political shifts and Canary Capital’s application for a Solana ETF, which could amplify gains. Since November 5, SOL has surged 35%, achieving a peak of $222—its highest since December 2021. Bitcoin’s own ascent, now trading at $84,500, further boosts optimism for Solana’s upward trajectory, largely driven by institutional interest and potential regulatory clarity.Solana’s TVL (total value locked) has also reached a new peak of $7.6 billion, outperforming many other altcoins. The rise in TVL, fueled by popular applications like Jito, Raydium, and Binance’s liquid staking, highlights the increasing utility and adoption of Solana’s ecosystem. Despite some concerns over Solana’s exposure to high-profile memecoins like Dogwifhat (WIF) and Bonk (BONK), its growing TVL and active smart contract use show strong fundamentals that could support future gains.Solana is now eyeing resistance levels at the 0.27 and 0.618 Fibonacci extensions, respectively $260 and $330, with the next major psychological target at $400. Analysts expect the $180-$200 range, previously a resistance zone, to provide solid support if SOL faces a pullback, offering a potential rebound zone for continued upward movement. With strong technical indicators and a favorable macroeconomic environment, SOL could be positioned for further gains in the near future. Solana’s bullish momentum has sparked fresh interest in its price potential as it broke past critical resistance zones, positioning itself for a significant rally. Starting November 5, Solana ended a prolonged consolidation period, marking a 14% gain that coincided with a sentiment boost from Donald Trump’s election win. Trading volumes spiked 27%, and high daily volumes lend credibility to Solana’s breakout, suggesting sustained growth as long as it holds above $200. Further enhancing market optimism, Canary Capital recently filed for a Solana ETF, potentially adding an institutional layer to SOL’s upward momentum.Solana’s growing TVL—now at $7.6 billion—demonstrates its expanding utility, with top decentralized applications like Raydium and Jito attracting notable capital inflows. Though Solana’s reliance on memecoins like Dogwifhat (WIF) and Bonk (BONK) has raised concerns, its expanding TVL and robust smart contract activity underscore strong fundamentals for continued growth. Analysts have identified key resistance points, with $260 and $330 as significant Fibonacci levels to watch. A move beyond $400 would likely bring Solana within reach of its ambitious targets, with a potential rebound off the $180-$200 range providing solid support if a downturn occurs.

Solana’s bullish momentum has sparked fresh interest in its price potential as it broke past critical resistance zones, positioning itself for a significant rally. Starting November 5, Solana ended a prolonged consolidation period, marking a 14% gain that coincided with a sentiment boost from Donald Trump’s election win. Trading volumes spiked 27%, and high daily volumes lend credibility to Solana’s breakout, suggesting sustained growth as long as it holds above $200. Further enhancing market optimism, Canary Capital recently filed for a Solana ETF, potentially adding an institutional layer to SOL’s upward momentum.Solana’s growing TVL—now at $7.6 billion—demonstrates its expanding utility, with top decentralized applications like Raydium and Jito attracting notable capital inflows. Though Solana’s reliance on memecoins like Dogwifhat (WIF) and Bonk (BONK) has raised concerns, its expanding TVL and robust smart contract activity underscore strong fundamentals for continued growth. Analysts have identified key resistance points, with $260 and $330 as significant Fibonacci levels to watch. A move beyond $400 would likely bring Solana within reach of its ambitious targets, with a potential rebound off the $180-$200 range providing solid support if a downturn occurs.