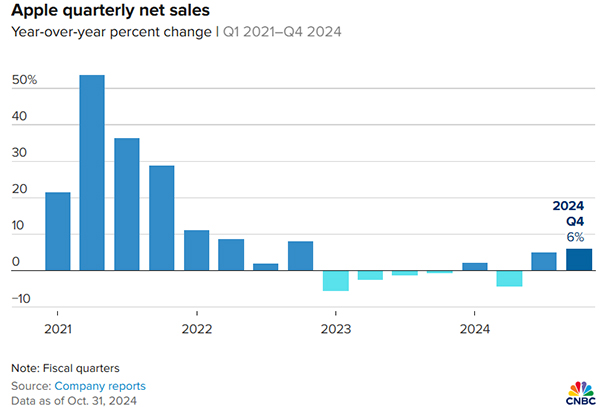

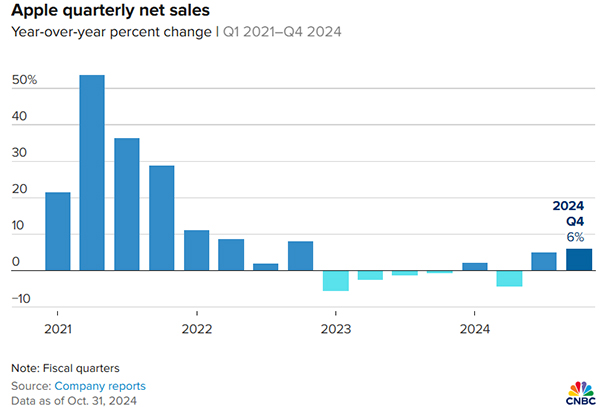

Apple posted solid fiscal fourth-quarter results that outperformed Wall Street’s expectations for revenue and earnings per share, despite a significant one-time tax charge impacting its net income. The tech giant's shares dipped slightly in after-hours trading.In the quarter ending September 28, Apple outpaced LSEG consensus estimates: Quarterly revenue growth reached 6%, supported by initial demand for the iPhone 16, which launched on September 20 and made up nearly half of Apple’s revenue. CEO Tim Cook noted a particularly strong demand, remarking that “iPhone 16 sales outpaced both the 15 and 14 models at launch.” Apple’s annual revenue rose 2%, totaling $391.04 billion, with $156.65 billion now in cash reserves.Hardware and Service Performance

Quarterly revenue growth reached 6%, supported by initial demand for the iPhone 16, which launched on September 20 and made up nearly half of Apple’s revenue. CEO Tim Cook noted a particularly strong demand, remarking that “iPhone 16 sales outpaced both the 15 and 14 models at launch.” Apple’s annual revenue rose 2%, totaling $391.04 billion, with $156.65 billion now in cash reserves.Hardware and Service Performance

While iPhone sales rose 6%, Apple's iPad saw the largest growth among hardware lines, increasing 8% to $6.95 billion in revenue, driven by recent releases of new iPad Pro and Air models. Mac revenue increased 2% to $7.74 billion, led by updated MacBook Airs for back-to-school season. Services, a core growth segment, expanded by 12% to just under $25 billion, although still slightly below expectations. Other Products, including AirPods and Apple Watches, fell short of forecasts at $9.04 billion, down 3% year-over-year.Global and Regional Performance

Apple’s performance in China, its third-largest region, dipped slightly year-over-year to $15.03 billion amid intensified competition from local brands such as Huawei. Meanwhile, Apple continued returning value to shareholders, spending $29 billion on share repurchases and dividends during the quarter.Apple also launched Apple Intelligence, its new AI-powered system, with the iOS 18.1 update, seeing double the early adoption rate compared to last year’s iOS rollout. Cook expressed enthusiasm for the strong feedback from both customers and developers.Key Takeaways Amid Tech Sector Earnings

Apple’s results capped a busy earnings week for Big Tech. Alphabet beat projections due to strong cloud revenue, while Microsoft’s guidance fell short, causing its steepest stock drop in two years. Meta beat earnings expectations but indicated it will significantly increase infrastructure spending in the upcoming year, and Amazon reported substantial growth in its AWS cloud business.

- Earnings Per Share (EPS): Adjusted EPS of $1.64 vs. $1.60 estimated

- Total Revenue: $94.93 billion vs. $94.58 billion estimated

- iPhone Revenue: $46.22 billion vs. $45.47 billion estimated

- Mac Revenue: $7.74 billion vs. $7.82 billion estimated

- iPad Revenue: $6.95 billion vs. $7.09 billion estimated

- Other Products Revenue: $9.04 billion vs. $9.21 billion estimated

- Services Revenue: $24.97 billion vs. $25.28 billion estimated

- Gross Margin: 46.2% vs. 46.0% estimated

Quarterly revenue growth reached 6%, supported by initial demand for the iPhone 16, which launched on September 20 and made up nearly half of Apple’s revenue. CEO Tim Cook noted a particularly strong demand, remarking that “iPhone 16 sales outpaced both the 15 and 14 models at launch.” Apple’s annual revenue rose 2%, totaling $391.04 billion, with $156.65 billion now in cash reserves.Hardware and Service Performance

Quarterly revenue growth reached 6%, supported by initial demand for the iPhone 16, which launched on September 20 and made up nearly half of Apple’s revenue. CEO Tim Cook noted a particularly strong demand, remarking that “iPhone 16 sales outpaced both the 15 and 14 models at launch.” Apple’s annual revenue rose 2%, totaling $391.04 billion, with $156.65 billion now in cash reserves.Hardware and Service PerformanceWhile iPhone sales rose 6%, Apple's iPad saw the largest growth among hardware lines, increasing 8% to $6.95 billion in revenue, driven by recent releases of new iPad Pro and Air models. Mac revenue increased 2% to $7.74 billion, led by updated MacBook Airs for back-to-school season. Services, a core growth segment, expanded by 12% to just under $25 billion, although still slightly below expectations. Other Products, including AirPods and Apple Watches, fell short of forecasts at $9.04 billion, down 3% year-over-year.Global and Regional Performance

Apple’s performance in China, its third-largest region, dipped slightly year-over-year to $15.03 billion amid intensified competition from local brands such as Huawei. Meanwhile, Apple continued returning value to shareholders, spending $29 billion on share repurchases and dividends during the quarter.Apple also launched Apple Intelligence, its new AI-powered system, with the iOS 18.1 update, seeing double the early adoption rate compared to last year’s iOS rollout. Cook expressed enthusiasm for the strong feedback from both customers and developers.Key Takeaways Amid Tech Sector Earnings

Apple’s results capped a busy earnings week for Big Tech. Alphabet beat projections due to strong cloud revenue, while Microsoft’s guidance fell short, causing its steepest stock drop in two years. Meta beat earnings expectations but indicated it will significantly increase infrastructure spending in the upcoming year, and Amazon reported substantial growth in its AWS cloud business.