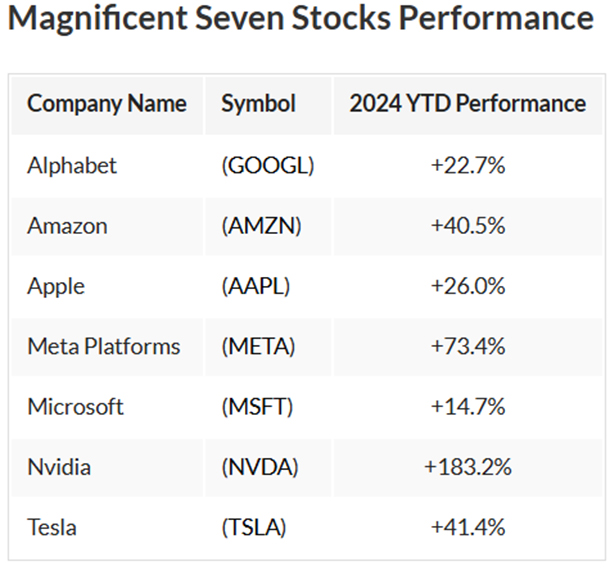

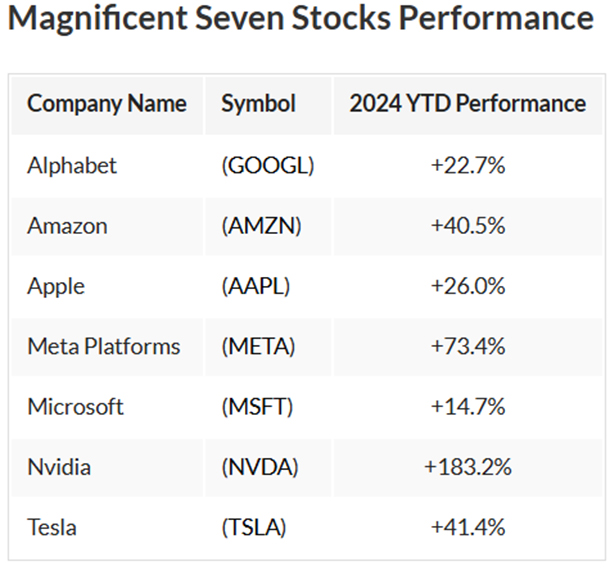

These tech heavyweights hold outsized influence on the Nasdaq composite and S&P 500 indexes due to their massive market capitalizations. For a closer analysis of their market impact, explore IBD’s coverage of the Magnificent Seven's weightings and financial performance. Nvidia Stock Struggles Amidst Chinese Investigation

Nvidia Stock Struggles Amidst Chinese Investigation

Nvidia shares dropped 3% on Monday following reports of a Chinese probe into alleged anti-monopoly violations. This dip pushed the stock below its 140.76 buy point and back to its critical 10-week line.While Nvidia outperformed Wall Street estimates for Q3 earnings, its sales outlook was only marginally above expectations. The company posted an adjusted profit of 81 cents per share on revenue of $35.08 billion for the quarter ending Oct. 27, compared to $18.12 billion a year earlier. Analysts had predicted earnings of 75 cents per share on revenue of $33.17 billion.Amazon Hits Record High

Amazon reclaimed its 201.20 buy point and edged up 0.4% on Monday, hitting a new high. The e-commerce and cloud leader exceeded analyst expectations for Q3, reporting adjusted earnings of $1.43 per share on revenue of $158.9 billion, surpassing predictions of $1.14 per share on $157.3 billion in revenue. Amazon continues to expand its AI presence through its Bedrock platform, offering managed services with foundational models from companies such as Anthropic, Meta, and Stability AI.Tesla Reverses After Highs

Amazon continues to expand its AI presence through its Bedrock platform, offering managed services with foundational models from companies such as Anthropic, Meta, and Stability AI.Tesla Reverses After Highs

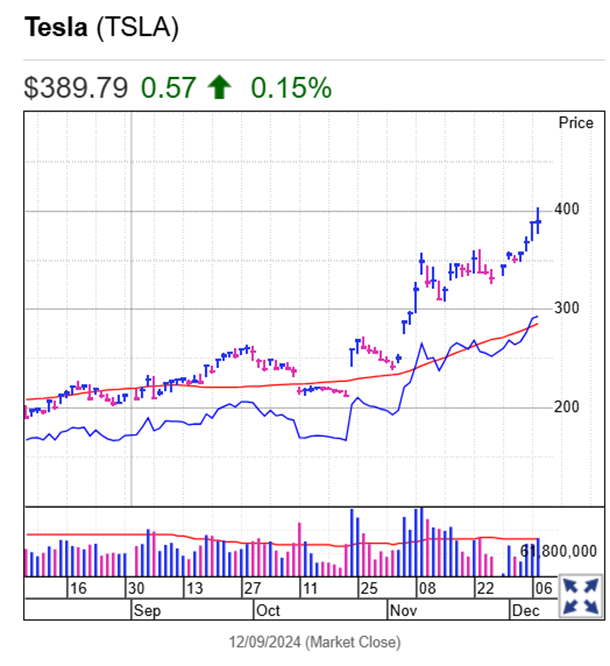

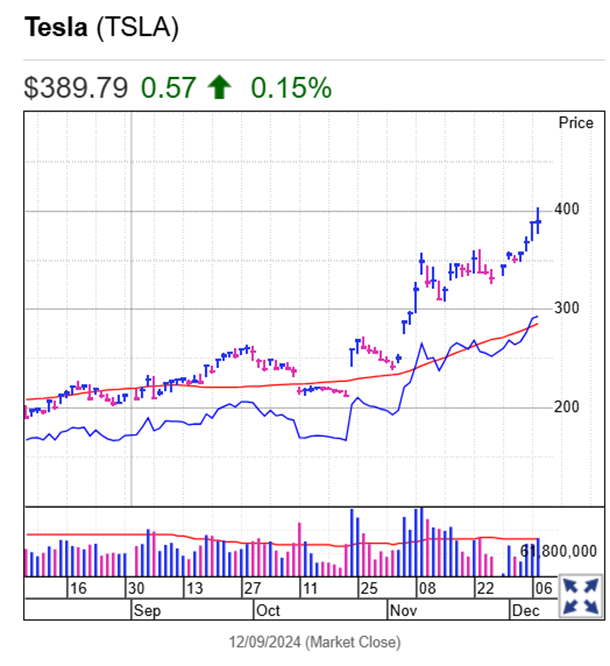

Tesla's stock fell 1.1% on Monday, breaking a three-day winning streak after touching a new high. Despite delivering a surprise Q3 earnings gain with a 9% profit increase, revenue fell short of expectations, tempering investor enthusiasm. Apple and Microsoft Hold Steady

Apple and Microsoft Hold Steady

Apple climbed 1.4% on Monday, advancing further past its 237.49 buy point. The company offered subdued guidance for the December quarter as adoption of its iPhone 16 AI features remains sluggish. Despite this, Apple reported fiscal Q4 earnings of $1.64 per share, up 12%, on revenue of $94.93 billion, up 6%.Microsoft also posted strong fiscal Q1 results, earning $3.30 per share on revenue of $65.6 billion, beating expectations. However, it issued conservative guidance for the current quarter.Meta Pulls Back, Alphabet Eyes Breakout

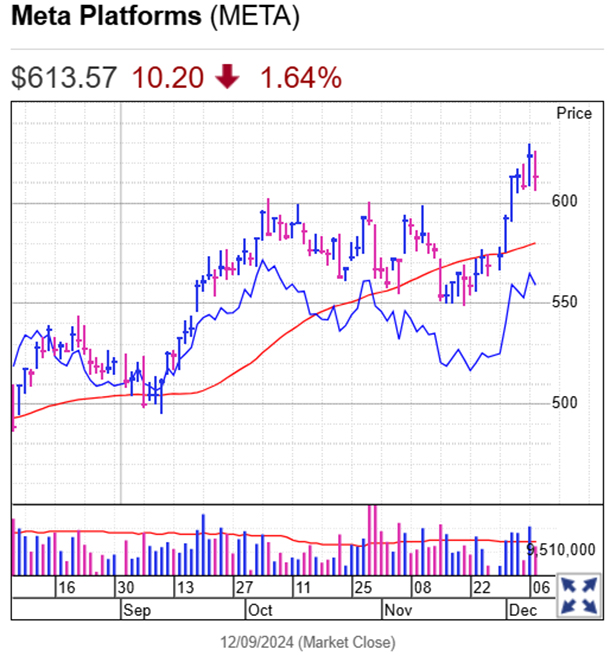

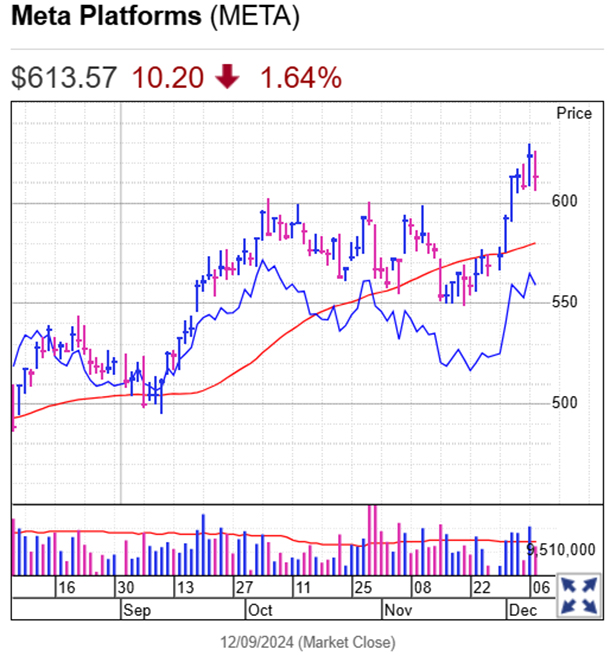

Meta Platforms dropped 2.2% on Monday, surrendering some gains after breaking past its 602.95 buy point last week. The company’s Q3 earnings exceeded estimates with a 19% revenue increase, though CEO Mark Zuckerberg emphasized continued heavy investment in AI and the metaverse. Alphabet, meanwhile, gained 0.1% Monday, forming a cup-with-handle pattern with a 182.49 buy point. Despite setbacks from a proposed DOJ breakup of its Google search business, Alphabet’s Q3 earnings and revenue beat expectations, bolstered by AI-enhanced search and advertising.

Alphabet, meanwhile, gained 0.1% Monday, forming a cup-with-handle pattern with a 182.49 buy point. Despite setbacks from a proposed DOJ breakup of its Google search business, Alphabet’s Q3 earnings and revenue beat expectations, bolstered by AI-enhanced search and advertising.

Nvidia Stock Struggles Amidst Chinese Investigation

Nvidia Stock Struggles Amidst Chinese InvestigationNvidia shares dropped 3% on Monday following reports of a Chinese probe into alleged anti-monopoly violations. This dip pushed the stock below its 140.76 buy point and back to its critical 10-week line.While Nvidia outperformed Wall Street estimates for Q3 earnings, its sales outlook was only marginally above expectations. The company posted an adjusted profit of 81 cents per share on revenue of $35.08 billion for the quarter ending Oct. 27, compared to $18.12 billion a year earlier. Analysts had predicted earnings of 75 cents per share on revenue of $33.17 billion.Amazon Hits Record High

Amazon reclaimed its 201.20 buy point and edged up 0.4% on Monday, hitting a new high. The e-commerce and cloud leader exceeded analyst expectations for Q3, reporting adjusted earnings of $1.43 per share on revenue of $158.9 billion, surpassing predictions of $1.14 per share on $157.3 billion in revenue.

Amazon continues to expand its AI presence through its Bedrock platform, offering managed services with foundational models from companies such as Anthropic, Meta, and Stability AI.Tesla Reverses After Highs

Amazon continues to expand its AI presence through its Bedrock platform, offering managed services with foundational models from companies such as Anthropic, Meta, and Stability AI.Tesla Reverses After HighsTesla's stock fell 1.1% on Monday, breaking a three-day winning streak after touching a new high. Despite delivering a surprise Q3 earnings gain with a 9% profit increase, revenue fell short of expectations, tempering investor enthusiasm.

Apple and Microsoft Hold Steady

Apple and Microsoft Hold SteadyApple climbed 1.4% on Monday, advancing further past its 237.49 buy point. The company offered subdued guidance for the December quarter as adoption of its iPhone 16 AI features remains sluggish. Despite this, Apple reported fiscal Q4 earnings of $1.64 per share, up 12%, on revenue of $94.93 billion, up 6%.Microsoft also posted strong fiscal Q1 results, earning $3.30 per share on revenue of $65.6 billion, beating expectations. However, it issued conservative guidance for the current quarter.Meta Pulls Back, Alphabet Eyes Breakout

Meta Platforms dropped 2.2% on Monday, surrendering some gains after breaking past its 602.95 buy point last week. The company’s Q3 earnings exceeded estimates with a 19% revenue increase, though CEO Mark Zuckerberg emphasized continued heavy investment in AI and the metaverse.

Alphabet, meanwhile, gained 0.1% Monday, forming a cup-with-handle pattern with a 182.49 buy point. Despite setbacks from a proposed DOJ breakup of its Google search business, Alphabet’s Q3 earnings and revenue beat expectations, bolstered by AI-enhanced search and advertising.

Alphabet, meanwhile, gained 0.1% Monday, forming a cup-with-handle pattern with a 182.49 buy point. Despite setbacks from a proposed DOJ breakup of its Google search business, Alphabet’s Q3 earnings and revenue beat expectations, bolstered by AI-enhanced search and advertising.